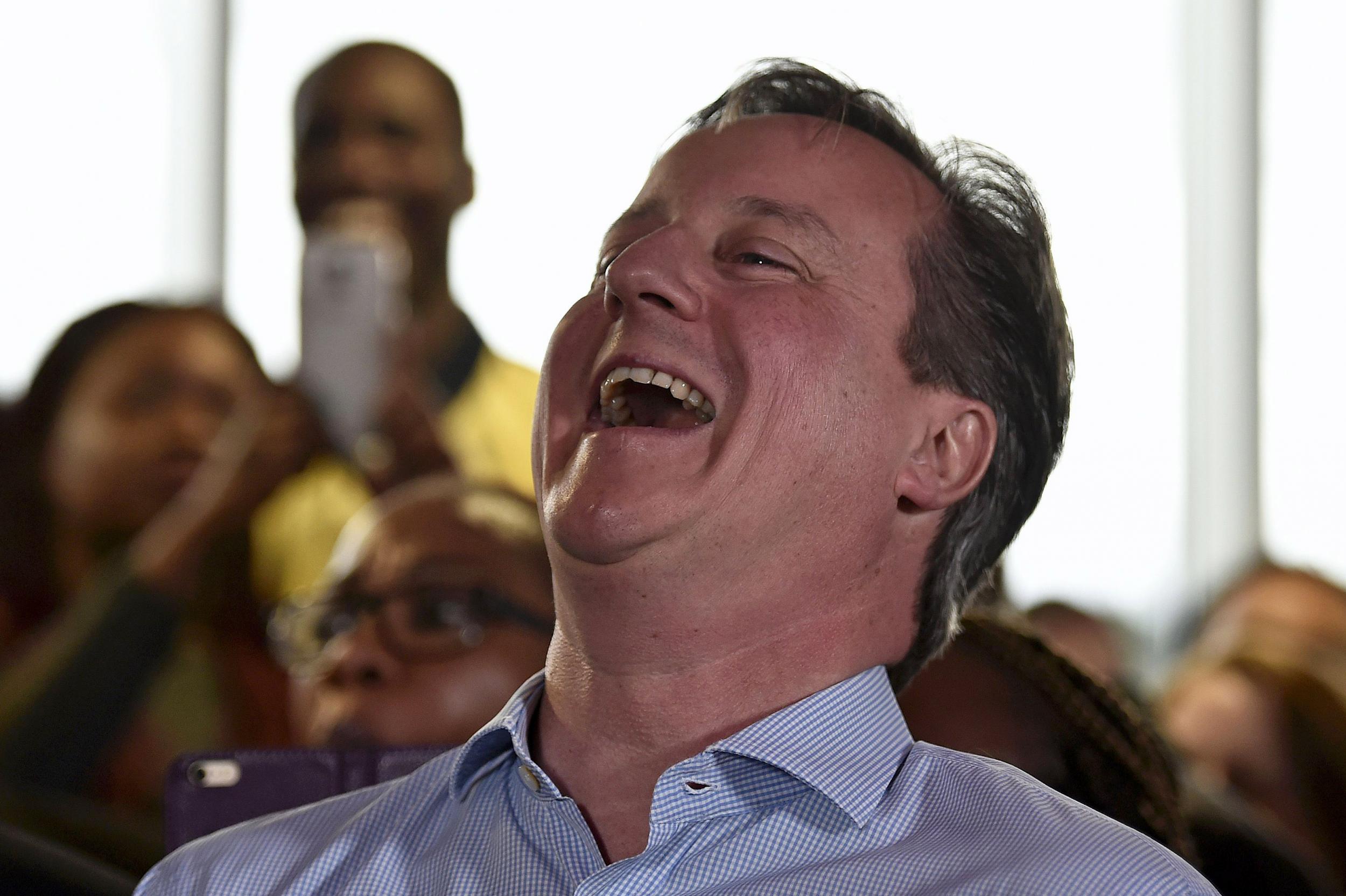

David Cameron offshore fund: PM still stalling on tax returns four years after he was 'relaxed and happy' about publishing them

Tax avoidance is 'frankly and morally wrong', the Prime Minister said in 2012

David Cameron said he would publish his tax returns almost 1,500 days ago, but has yet to follow through on the promise.

The Prime Minister admitted on Thursday that he sold shares worth £30,000 in his father's offshore investment fund – after it was exposed by the Panama Papers – shortly before being elected Prime Minister in 2010.

He also promised to "get on" and publish details of his personal financial affairs with a spokesperson for Number 10 saying following his admission that his tax returns would be made public "as soon as possible".

The Independent contacted Downing Street on Friday to ask when this was likely to happen but has yet to receive a response.

10 of the biggest tax havens in the world

Show all 10Mr Cameron made the same promise four years ago in April 2012 when he was reported to be "relaxed and happy" about publishing his returns.

And he used almost identical language on Thursday -- despite only revealing he had shares in his father's trust several days after its existence was made public.

"The idea of publishing the information that goes in your tax return, I'm very relaxed about that. I'm happy to get on and do that now. Whether we do that every year or starting now or going back a couple of years, whatever, I'm very happy with that," the Prime Minister told ITV's Robert Peston.

As he confessed he had once owned offshore shares worth more than the average annual UK income, the PM also admitted he could not be sure that some of his £300,000 inheritance had not passed through an offshore tax haven such as Jersey.

Mr Cameron made £19,003 by selling shares in his father's unit trust fund, just £300 below the capital gains tax threshold. The sale of his Blairmore shares was "subject to all the UK taxes in all the usual ways", he added.

Mr Cameron says the offshore fund, Blairmore Holdings, was not set up in order to avoid tax, although Blairmore has paid no UK tax in its 30-year history.

"I've never hidden the fact that I'm a very lucky person. I had wealthy parents... I've never tried to be anything I'm not," he added.

The Prime Minister has previously described tax avoidance as "frankly and morally wrong" and said that "those who want to evade taxes have nowhere to hide".

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies