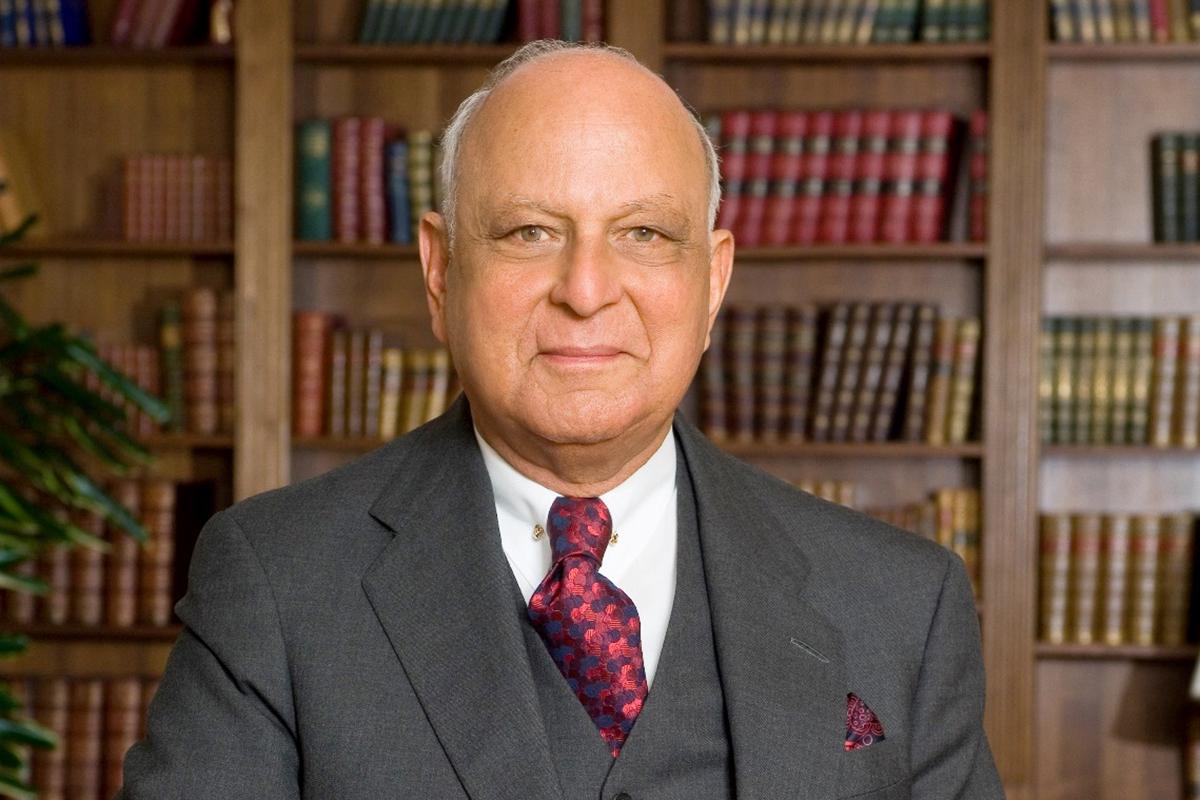

Nemir Kirdar: A father of private equity in the Persian Gulf

The businessman was a soft-spoken but enormously influential figure in the Middle East, where he cultivated relationships with Bahraini emirs, Saudi princes and Jordan’s Hashemite monarchs

Nemir Kirdar, an Iraqi expat who helped spur a private equity boom in the Persian Gulf, founding the investment firm Investcorp in Bahrain to connect oil-rich business executives, royals and politicians with luxury brands and other investment opportunities in the west, died 8 June at his home in Antibes, France. He was 83.

A spokesperson for Investcorp, which Kirdar founded in 1982 in the Bahraini capital of Manama, said he had dementia. He had led the company for more than three decades, stepping down as chief executive in 2015 and continuing to serve as chairman until retiring two years later.

Kirdar was a soft-spoken but enormously influential figure in the Middle East, where he cultivated relationships with Bahraini emirs, Saudi princes and Jordan’s Hashemite monarchs while travelling the world and meeting with leaders such as US president Bill Clinton and British prime minister Margaret Thatcher. Growing up in a prominent Iraqi family, he had nurtured political ambitions of his own and was a childhood playmate of King Faisal II, whose execution during a 1958 revolution led Kirdar to immigrate to the United States.

He eventually returned to Iraq before fleeing the country a second time, after being thrown into a Baghdad jail cell in 1969 and held for 10 days, with no charges ever filed. By then, the Baathist regime had come to power and Saddam Hussein was a decade away from formally taking the presidency.

Kirdar decided that it was time to trade public service for business and launched a career in international banking, leading Chase Manhattan’s regional operations in the Persian Gulf before forming his own company.

He said he dreamed of building an investment bank “like something JP Morgan envisaged” and assembled a formidable group of founding shareholders for Investcorp – including sitting government officials and 67 sheikhs from Saudi Arabia, Bahrain, Kuwait, the United Arab Emirates and Qatar, according to Euromoney magazine.

“We wanted to be a bridge between Middle Eastern investors with excess funds and those companies in the west that needed new capital,” Kirdar told Forbes in 1987. A co-chief operating officer, Elias Hallack, later put it differently: “We are the billionaires’ investment bank.”

With a focus on real estate and luxury brands, Investcorp went on to own or hold major stakes in companies including Tiffany & Co, Saks Fifth Avenue, Gucci, the French jeweller Chaumet and the Swiss watchmaker Ebel. It also snatched up American brands such as Carvel ice cream, Peebles department stores and Circle K convenience stores.

Kirdar developed a reputation as a master salesman while pitching his firm to corporations and investors. Early in his career, he spent his rare days off visiting potential clients, once watching as ambassadors, coffee servers, falcon keepers and the like paraded inside the emir’s palace in Bahrain, where Kirdar was eventually granted the opportunity to shake the ruler’s hand.

His firm also distinguished itself by inking deals with a high component of equity relative to debt, and by holding onto companies twice as long as many competitors – often for seven years – before selling them off whole, typically without breaking up businesses and auctioning off the parts.

The Investcorp approach drew praise from Wall Street and from executives such as William Chaney, the chairman of Tiffany, whom Kirdar courted intensely before securing a $135m deal to purchase the company from Avon Products in 1984. Three years later, Tiffany went public, reportedly earning Investcorp more than $100m on its investment.

“Kirdar was a brilliant executive and financial person and extremely high principled,” Chaney told the New York Times in 1993. “I like his philosophy of looking at an acquisition not only from the financial aspects, but also at the basic business concept and management.”

Nemir Amin Kirdar was born in Kirkuk, the oil capital of Iraq, on 28 October 1936. The third of five sons, he was born in the same grand old home as his parents, first cousins who traced their ancestry back to a tribal family in present-day Turkmenistan. While his father was a law school graduate and civil servant who served in parliament before the 1958 coup, his mother helped lead an Iraqi women’s group and “was the more ambitious of the two”, Kirdar wrote in a 2012 autobiography, In Pursuit of Fulfilment.

Kirdar studied engineering at Robert College, an American school in Istanbul, before moving to the United States and attending the College of the Pacific (now a university) in Stockton, California. He received a bachelor’s degree in economics in 1960 and, after his short-lived return to Baghdad, received an MBA from Fordham University in New York City in 1972.

Kirdar worked for Allied Bank International before joining Chase Manhattan, where he recommended that the company form a merchant bank in the Middle East after the oil price shock of 1973. When the plan was endorsed by Chase chairman David Rockefeller, he moved to Abu Dhabi and then Bahrain, where according to the Wall Street Journal he set up shop at a Holiday Inn.

“I went to the Gulf in 1976, at the height of the oil boom, and the amount of money that people made there was staggering,” Kirdar later told the Times. “At that time, it was tempting to go off on one’s own.”

He took a year off from Chase to work as an adviser to the Arab Monetary Fund, where he developed the idea behind Investcorp and soon launched the business with former Chase colleagues such as Savio Tung, who now heads Investcorp’s technology investment wing.

“We were a nobody,” Tung said in a phone interview, recalling the firm’s early years. “We had a bit of a PR issue in terms of getting recognised and getting people to appreciate that we were a professional, serious investment firm.”

“While competing to acquire Tiffany, we actually had to use another investment bank’s reference to tell them that we were responsible investors and credible,” he added. The deal opened the door to further transactions with major brands – notably Saks, which Investcorp bought for $1.5bn in 1990.

Kirdar championed cultural exchange between the Middle East and the west, in addition to building economic ties between the two regions. At the University of Oxford, he backed the construction of a new Middle East centre designed by architect Zaha Hadid; at Georgetown University, he chaired the advisory board of the Center for Contemporary Arab Studies for more than a decade.

In 1967, he married Nada Adnan Shakir. She survives him, in addition to his two daughters, Rena Kirdar Sindi and Serra Kirdar; two brothers; and three grandchildren.

By the end of 2019, Investcorp had $31.1bn in total assets under management and offices in cities including New York, London and Mumbai. Its deals had also made Kirdar a fortune, enabling him to buy an Antibes villa he named Serenada, combining the first names of his daughters and wife.

His guests there included the king and queen of Jordan as well as Camilla Parker Bowles and her future husband, the Prince of Wales.

Nemir Kirdar, financier, born 28 October 1936, died 8 June 2020

© The Washington Post

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies