Bank set to miss inflation target just as Mark Carney becomes governor post

Mark Carney, the incoming Governor of the Bank of England, could be forced to write to the Chancellor to explain away high inflation within days of starting his new job after a jump in the cost of living last month.

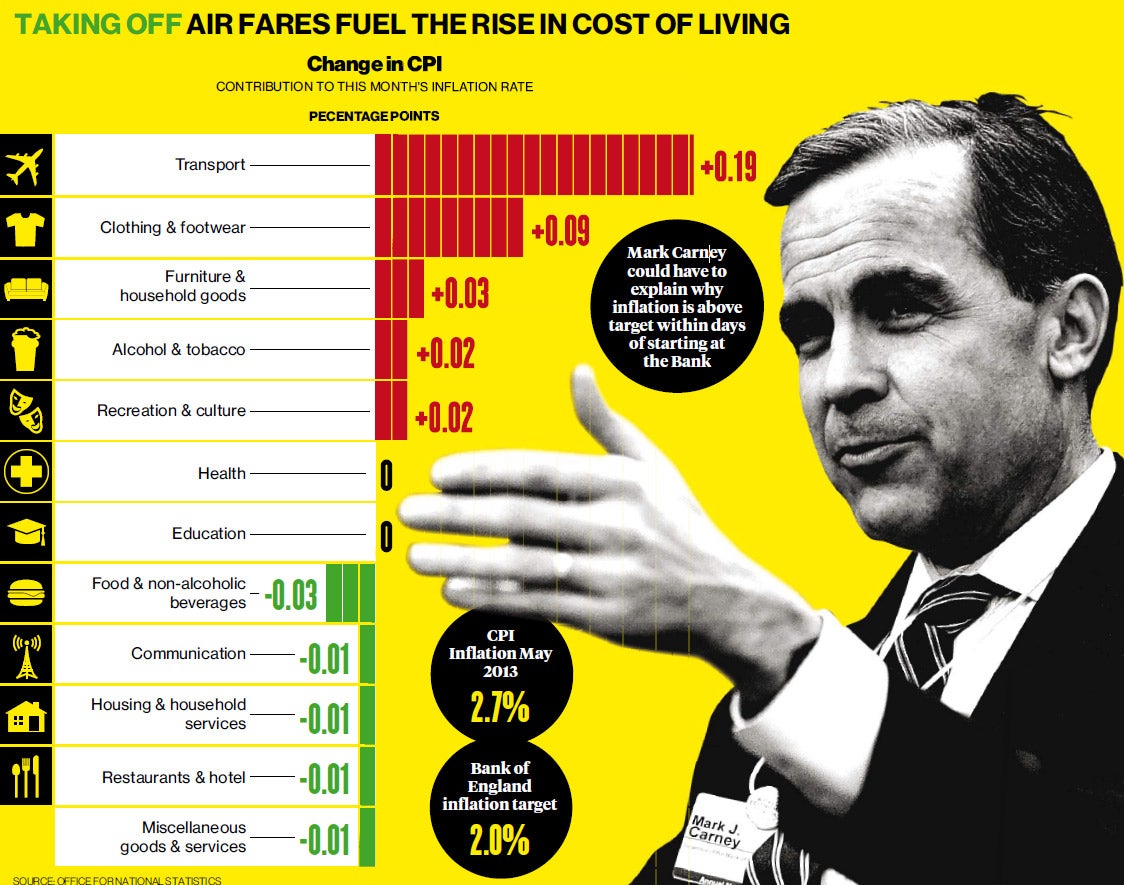

The rise in the consumer prices index to 2.7 per cent – with further increases expected in June – was higher than expected in the City and puts Mr Carney in danger of an embarrassing start to his five-year tenure in Threadneedle Street. The Governor has to write a public letter to the Chancellor if inflation deviates from the 2 per cent target by more than 1 per cent in either direction.

The figures also mean the current Governor, Sir Mervyn King, who has written 14 open letters to George Osborne, Alistair Darling and Gordon Brown since 2007, will leave office at the end of this month with inflation above the target. He recently blamed "own goals" such as last year's tuition fee increases for inflating the cost of living.

The latest increase was driven largely by rising air fares, 22 per cent higher than in May last year. This was put down to the timing of Easter, which fell in April in 2012 and prompted bigger discounts the following month.

A smaller fall in petrol and diesel prices than a year earlier added to the inflationary pressure while the lingering cold weather also pushed up the cost of jackets last month, the Office for National Statistics said.

Philip Shaw, Investec's chief economist, said: "These figures raise the likelihood that June's CPI rate edges above the 3 per cent threshold, especially as petrol prices seem to have firmed again in recent weeks."

Inflation has now been above the Bank's target for 42 months in a row. Under the Budget changes to the Bank's mandate, any letter from the new Governor triggered by June inflation exceeding the target by more than 1 per cent will be published alongside the minutes of the Monetary Policy Committee's next meeting in August.

The Bank's latest May forecasts predict the cost of living will peak at 3.1 per cent in the third quarter of 2013 before falling back.

The figures also underlined the continuing squeeze on household budgets, with recent figures showing average salaries growing at just 0.9 per cent, three times lower than the cost of living.

Colin Edwards, an economist at the Centre for Economics and Business Research, said: "The elevated unemployment rate, which stands at 7.8 per cent in the latest data, means that this situation looks set to persist, weighing on consumer spending power and hampering economic recovery."

Mr Carney is expected to introduce guidance on interest rates in August, potentially boosting the recovery by offering assurances on loose monetary policy, although the higher than expected inflation means that he may struggle to persuade a majority of the nine-strong MPC to sanction more quantitative easing. Sir Mervyn has been voting without success for more stimulus since February.

Simon Hayes, the chief economist at Barclays, said: "Today's news reinforces the view that an expansion of QE under the new governor Mark Carney is far from being a foregone conclusion."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies