Hamish McRae: Once house prices stop falling, we can start thinking about recovery

Economic Life

So now it is official: the US economy is shrinking. For the first half of this year it continued to inch forward, unlike that of the eurozone, which contracted in the second quarter. But now we have had confirmation that the third quarter was down, driven by a sharp fall in consumption. Since that accounts for 70 per cent of GDP the fact that other components, notably exports, were up did not affect the outcome.

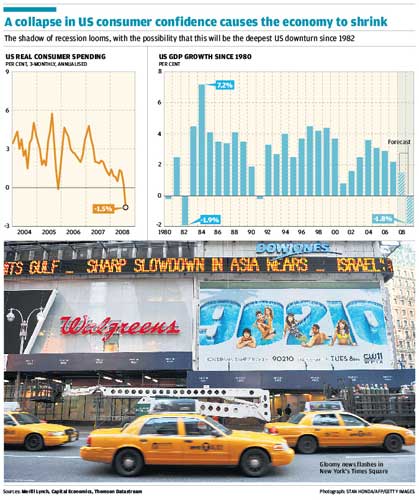

This fall was widely expected; indeed most forecasts had pencilled in an even greater fall in GDP than the 0.3 per cent annualised that occurred. The concern is that this is really just the start of something much bigger, for the fall in consumption occurred before the credit crunch intensified at the beginning of September and spending has collapsed further since then. (Retail sales were up in July and flat in August, only declining in September.) At any rate the bottom line is that the consumption fall was 3.1 per cent annualised, the first such decline since 1990 and the biggest since 1980. As the first graph shows, something important is happening.

It is difficult from a distance to catch a feeling for the scale of the shift in mood. I know there are the various confidence surveys which measure the purchase intentions of people and they confirm that there has been a collapse in confidence. But they are inevitably imperfect, rather as voting intention polls are imperfect, partly because they record what people say rather than what they do and partly because they don't explain why people are spending or not spending more. It would be good to know whether the fundamental fear is one of unemployment, or higher taxes under a new president, or a credit card company that has indicated that it might want to reduce credit limits, or whether it is share market falls, or even just a shift in fashion towards prudence. You really only get a feeling for this by chatting to real people rather than looking at numbers.

Consumption is the key. Until we know more about what is happening we cannot really predict the profile of this recession with any confidence. My instinct has long been that it will be long but shallow – a "U" rather than a "V" – but that is just an instinct. But it does break down into two questions: why long, and why shallow?

First, as a frame of reference, have a look at the growth figures for the US economy going back to 1980 set out in the other graph, plus the Merrill Lynch forecasts for this year and next. These are done annually, which seems to be a more sensible way of thinking about recessions than focusing on the technical definition of recession of two consecutive quarters of negative growth. (Come to think of it, that common expression "negative growth" is a silly one, when what is meant is that the economy is shrinking: if it is negative, it's not growth.)

As you can see from the annual figures, for the US, 1980 and 1982 were a nasty double-dip, 1991 was a minus but not a terrible one, and 2001 was actually a plus, albeit only 0.8 per cent. Merrill Lynch comes in with a plus for this year but a minus 1.8 per cent for 2009. Ouch. That would mean that 2009 would be the worst year for US growth since 1982, suggesting that we should be prepared for the full Monty and my "shallow but long" instinct will be wrong.

So why shallow? Mainly because I think that the combination of very low interest rates and huge injections of liquidity into the banking system will make credit sufficiently available for US consumers to recover their nerve next year. I don't think the consumer ethos is broken. It has taken a beating, sure, and that beating ain't over by any means. In the longer term the share of American GDP that is consumed will have to fall from its present 70 per cent to perhaps 65 per cent but that can happen over several years. Meanwhile the US has demonstrated that it can still attract savings from the rest of the world – witness the continuing strength of the dollar.

A subsidiary reason for confidence that the recession will be relatively shallow is exports, which have been really very strong indeed. US competitiveness will have been dented by the recent rise in the dollar but not destroyed. One of the wonderful things about large US companies is that if they can see a profit in some export market they will throw huge resources at achieving that.

Why long? That is the flip side of the above. There are large imbalances that have to be tackled and if they are tackled slowly it will take longer to re-establish sustained growth. The shallower the recession the longer it will last. US total debt is around 350 per cent of GDP if you add public debt, that of corporations and that of individual households together. That is the highest level ever in the history of the country, higher even than in 1929, though not as high as that of Japan. But then Japan has shown what happens to countries that struggle under a burden of debt: they are liable to stagnate. The US is not in as bad a position as Japan for demographic and other reasons, nevertheless it will take some years to pull back debt to a level that the country is comfortable with. So debt should be seen as a headwind into which the different parts of the economy, but particularly consumers, will have to butt.

What could change this? One obvious candidate would be a series of corporate failures. We have learnt in the past few weeks that the US authorities will do whatever they have to to shore up the financial system. They may well have to do more, but they will. What we don't know is how far they are behind the weaker large corporations. That is why the General Motors/Chrysler merger is so important because it will need surely some Federal support. As consumption continues to fall the balance sheets of many major corporations will come under pressure; this is not something that just hits the profit and loss account. So there will be trouble ahead.

Another thing that could change it would be a botched economic package by the new president. I don't think we should assume, whoever wins the election, that the next presidential team will get it right first time. There will be a general presumption that the next administration will be more competent than the present one and let's hope that is right. But new administrations often make mistakes in their first months in office.

Finally there are external events, the unpredictable shocks such as something going very wrong in the Middle East. It would not take a lot to tip a mild recession towards becoming a deep one. And shocks, by their very nature, are likely to be negative rather than positive.

What should we look for, when trying to calibrate the forthcoming US recession? My own key indicator, more important than any other, would be US house prices. Once they stop falling it will be possible to figure out the scale of the banking debts. That would be a huge relief to the markets. A market rebound would help restore some consumer confidence but housing stability would do even more. Say, just as a proposition, that US house prices stop falling by next autumn, that would be the signal that recovery could begin.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies