Hamish McRae: Borrowing to spend? Tut tut. These days the fashion is to pay off our debts

We still want to own our own home but we don't want to have to borrow to do so. It is of course a bit early to start to think about the changes to behaviour that this period of wobbly house prices and very low deposit rates might be generating.

And you only have to look at the interest rate charged on some credit cards to see that people are far from rational about money. Who on earth would be prepared to borrow at 46 per cent, a rate I saw quoted on one card just last week?

Still, some remarkable things have been happening. One is that people have been paying back their mortgages. It of course makes sense to do so for anyone with spare cash. Deposit rates from the mainstream banks are very low and while mortgage rates have come down for some people (anyone with a mortgage linked to base rate is doing wonderfully) the gap between average mortgage rates and average deposit rates remains historically high.

But quite aside from the rational case for paying back a mortgage, there is the emotional one. Think back five years. During the boom there were social pressures to borrow more. People felt secure about their jobs and real earnings were rising. House prices were strong and there were a host of new lenders. Remember how credit cards with names of foreign banks you had never heard of landed on the door mat. A bit of paperwork and off you trotted with another £5,000 of credit to misspend. Borrowing was not just socially acceptable; not to do so was fuddy-duddy.

That has all changed. People don't boast of how much they have borrowed; they are more proud of how much they have paid off. The anti-bank propaganda has hit home. If you are not borrowing you are not giving them the business. You are taking out your frustration in the most direct way.

There is a further point. Paying back loans means you are better defended against adversity. People in the private sector have seen the disruption to people's lives as businesses have shed staff, or cut working hours, to survive. Now public-sector workers will go through a similar process, though their pensions at least will be better protected. Not having large debts gives you greater options should things go downhill. You can wait longer for a new job rather than take the first one that comes up. Meanwhile, one of the uses people have made of redundancy payments has been to clear the mortgage.

How big is the trend to clear debt? It is hard to pick out early redemptions from the normal flow of data, so the evidence is hard to show. We know that net lending is roughly breaking even. In other words the flow of money being repaid is a touch below the amount of money being lent, but that is more the result of the fall in lending than a rise in repayments. We know too that there has been some rise in the past few months of lump-sum repayments. And we know that equity withdrawal, whereby people borrowed against their homes in order to boost consumption, has gone into reverse.

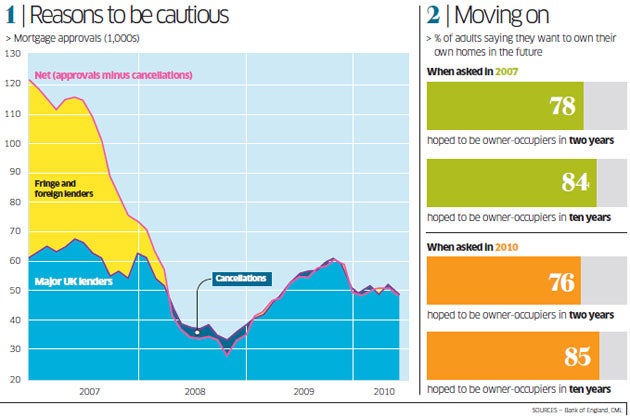

Parallel to this retreat by borrowers has been a retreat by fringe and foreign lenders. The main graph shows how the top British-based mortgage providers have hardly changed the number of loans they have been approving over the past three years. The top five lenders, by the way, are Santander, Barclays, HSBC, Lloyds, Nationwide, and the Royal Bank of Scotland group. The dramatic thing that has happened is that fringe lenders have pulled almost completely out of the market. (Not all loans gaining approval are taken out, hence the possibility for total loans to dip below the number approved by major lenders – see graph.)

That changes the dynamics. Instead of there being a barrage of inducements from fringe lenders anxious to gain market share, there is a culture of caution. If lenders are more cautious, borrowers are forced to become more cautious too. This is common sense.

However, we do still want to own a home, notwithstanding the fall in the market from the peak, the modest recovery and now the fact that house prices seem to be falling again. The Council of Mortgage Lenders has done some research on the extent to which the house-price slump might have made home-ownership less attractive. It reports that there has been a very slight fall in the proportion of people who say they would like to live in their own homes now, or within two years (see right hand of chart), but if people are asked whether they would like to be living in their own home in 10 years, the proportion seems to have risen a bit. Home ownership remains the aspiration of 85 per cent of us.

So what does all this signify? As I say, it is early to be drawing confident conclusions about changes in social attitudes, but try this: We have had a half century or so when thrift has been, if not discouraged, at least not a priority of public policy, and where borrowing has been encouraged, if not by government, at least by the financial service industry. Think back: There used to be embedded in Britons a suspicion of getting into debt, except for home purchase, at least until the 1950s. Gradually the UK has moved towards the US model of easily available credit. The final throw of that dice in the US – the Federal government encouraging people who were not creditworthy to borrow on mortgages – precipitated this recession.

So now credit is being restricted and, given the hostility of politicians to bankers, will continue to be restricted for some time. The foreign banks that lent all those additional mortgages are not going to return to the UK fast. So the really interesting question is whether the hostility towards bankers will translate into, if not a hostility, maybe a caution, towards credit in general.

Social change does not happen suddenly. So the question will not be swiftly resolved. But it is at least plausible that this could be some sort of turning point, analogous to the shift in attitudes in the 1950s but in reverse. So borrowing to finance consumption, rather than proper investment, will become progressively more frowned upon. Thrift will start its comeback.

If China and the US cannot find a way to agree over trade, we will all suffer

The tension between China and the US has become more evident – and more troubling. The assumption has been that the two economies are so intertwined that a trade war is unthinkable. But there have been rumbles in Congress about the undervaluation of the yuan. Last Thursday, Tim Geithner, the treasury secretary,said that the administration was looking at tools to encourage China to allow a revaluation.

There are two obvious problems and one less obvious one. First, China does not accept the US argument that its currency has been the main reason for the US's failure to make a more robust recovery form recession.

Second, since China has in effect become the principal financier to the US government, if it were to revalue, that would give it a huge loss on its holdings.

The third and less obvious is the lesson of Japan. In 1985 Japan agreed to allow its currency to rise in order to cut its surplus with the US and head off a threat of retaliation. This was agreed at New York's Plaza Hotel and came to be dubbed the Plaza Pact. It relied more on a statement, but there was also central bank intervention. The pact was a success – the yen rose and the dollar fell back – and it led to the Louvre Accord two years later, whereby the developed countries agreed to hold currencies within unpublished bands. That helped bring discipline to the exchanges and built confidence.

But in China, Plaza is seen rather differently. I recall a conversation with a Shanghai official who put the tale this way: Japan had allowed itself to be bullied by the US and was set on a path that led to its eclipse as an economic powerhouse. China will not make that mistake.

It is hard to see this being resolved easily. Getting two proud countries to modify their policies will not be easy and if this goes wrong the rest of us will get caught in the crossfire.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies