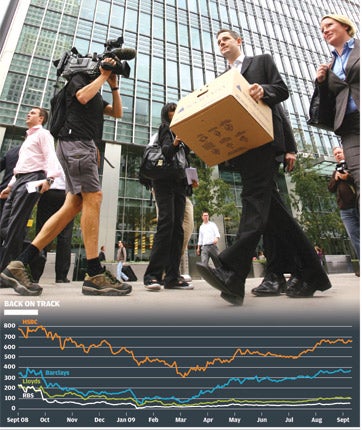

Will banking's share bounce last?

Britain's banks may have come back from the brink but should investors still watch their step? Julian Knight investigates

It's almost a year since the string of events that brought the financial system to the brink of the abyss started with the collapse of Lehman Brothers. For a time it looked as if the life savings of millions of Britons could be about to disappear down the Swanee.

The scars from this period are probably still felt keenly by many private investors and savers today – and who can blame them? But for some, the collapse of Lehman and the later part-nationalisation of Lloyds Banking Group (the amalgam of Lloyds TSB and the Halifax) signalled the low point of the crisis – from there the only way was up.

When it comes to banking shares, the old adage that investors should sell in May and stay away till St Ledger's day (12 September) would have proved costly to follow. Over the summer months, the share prices of UK banks – and Barclays in particular – have shot up as investors have returned to banking stock.

"The banks are out of intensive care. From 1 March up to mid-August, bank shares went up on average 80 per cent," says Chris Sugg, the head of UK products at fund management group Fidelity.

And the figures are eye-catching, just as long as you conveniently forget the awful performance from late 2007 to spring 2009. Barclays' share price, for instance, buoyed by strong returns from its investment banking arm, has grown seven-fold since March and is near the price level seen before the collapse of Lehman. HSBC, after losing over half its share price between autumn 2008 and spring 2009, has recovered most of the losses in the summer's market rally. The share price of Royal Bank of Scotland currently stands at 56p; in January it was a little over 10p. Even Lloyds – which is seen as having too much exposure to UK consumer debts – has doubled in price since it reached its nadir in March.

"The banks have really led the way in the stockmarket recovery. This is for three reasons: first, they were oversold following the crisis of last autumn, so there was a lot of slack to come back; second, the world economy looks like it's moving ahead more quickly than first thought, and finally, we have seen a lot of the bad news got out of the way in the bad debt write-off figures," says Jonathan Jackson, the head of equities at stockbrokers Killik & Co.

But what does this mean for small private investors? Should they now forget the horrors of last autumn and put their faith once again in Britain's banks? Whether or not you think that Britain's banks are worth backing depends on lots of different factors, the first of which is how you view the UK and world economy panning out.

"There are lots of negatives in the UK economy," says Justin Urquhart Stewart from Seven Investment Management. "Taxes are set to rise, while consumers still have a massive debt burden, and with 60 per cent of the economy relying on consumer spending, the next few years are going to be a real slog and that is going to be reflected in banking."

Mr Urquhart Stewart adds that he worries that there is still bad news on the way in terms of banks writing off debts not from sub-prime mortgages in the US but from consumers and businesses in the UK. "I still fear for the balance sheets of RBS and particularly Lloyds has a lot of exposure to UK debts, and I could even see a scenario where the Government has to take an even bigger stake in the banks. This is still a dangerous period for Britain's banks as we tentatively move from recession to a limited recovery," he says.

As for Barclays, the big success story – from a share price perspective – of the past six months, Mr Urquhart Stewart also has concerns: "The investment management of Barclays has posted big profits, but really I think how it makes its money is a little too opaque. What will happen to Barclays' share price if one quarter of the profits turn to losses or are reduced?"

Most analysts, though, think that banks that do a lot of business outside the UK are better set. "Standard Chartered and HSBC both do lots of business in the emerging economies that means they are well placed as they will benefit from the continued growth in these economies," says Mr Jackson.

Crucially, both Standard Chartered and HSBC are still paying dividends, something which may become a rarity in the UK banking sector over the next few years. "Lloyds and RBS have to pay back the Government's stake first before they can even consider paying a dividend to shareholders; this removes one of the traditional reasons for investing in banking shares, namely the regular dividend," says Mr Jackson.

As for future profits, opinion is mixed. "We are yet to see the effect of extra regulation on the banking sector, but for those banks that haven't accepted government help, the prospects look good, as margins between the cost of money they bring in and the price that they lend out are quite high; there is also a little less competition in the sector," says Mr Sugg.

But for others, there are better investment plays out there. "When investors ask me about investing in banking shares, I'm cautious in my response," says Paul Hutton from Black Swan Capital Wealth Management. "If you're not already invested in banking shares then I'm afraid you've probably missed out on the best of the recovery. In this climate, investors should be looking to diversify across lots of different sectors such as natural resources, emerging markets, bonds and cash. Most investors buy funds rather than individual company shares, and those that do, I'm advising to reduce their exposure to Europe and the UK, and that particularly applies to funds heavily invested in banking," he adds.

A little research can reveal how heavily a particular fund is invested in banking stocks – most fund marketing information gives a rundown of the 10 biggest holdings and the proportion of stocks held in a sector.

Before being too bank-averse, it is worth bearing in mind that any fund manager who had veered away from the sector in recent months will have missed out on unprecedented price growth.

Mr Urquhart Stewart probably best sums up the feelings of a fair few City insiders. "I bought into financials in the spring, mainly because of the rock-bottom prices, but I think I will stay away from them for the time being. If you're sitting on profits from the summer rally, now may be the time to cash them in," he says.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies