How to financially survive a no-deal Brexit

Crash out or cruise through (yeah, right), you need to make plans to weather whatever happens next

It’s really time to get ready for Brexit. Yes, things are slightly more urgent if you’re a government minister or a farmer or you have an interest in just-in-time supply chains.

But even if you’re a normal person then there’s not much time to get your finances braced for a possible no deal.

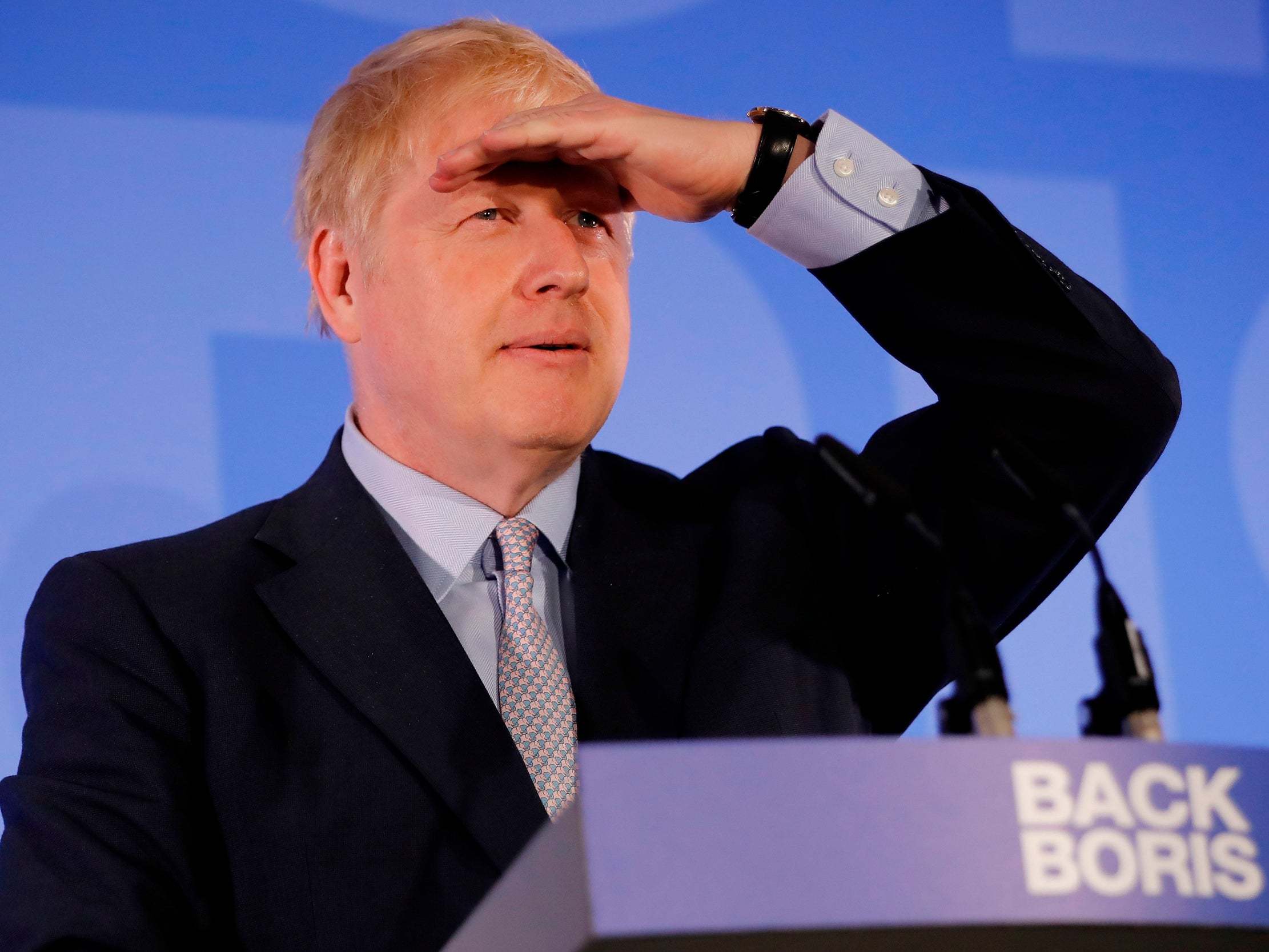

Boris Johnson has maintained the chances of a no-deal exit are “a million to one” but, despite that, it’s clearly an increasingly likely outcome.

That leaves just a handful of weeks to prepare. By the time you’re stocking up on Halloween sweets, it will be too late.

So what can you do in just three months? Here are some ideas.

Know where your money is

A no-deal Brexit could mean bumpy times ahead, whether that’s a short-term blip or the full-blown recession some people believe is ahead.

Drawing up a budget means you know exactly what you can cut back on if times do get difficult.

Aashna Shroff, a personal finance spokesperson at money.co.uk, said: “The most helpful thing you can do is to get a clear idea of exactly how much you are spending every month. If you know what you are spending, you can see where you are able to cut some costs.

“I would draw up a budget so you can see exactly how much you are spending on your fixed, essential costs like mortgage or rent, utility bills and school fees, as well as other variable essential items like food and clothing.

“You also need to break down how much you are spending on life’s luxuries, such as entertainment and eating out.”

Make some savings, any savings

Three months is not long to build up a financial safety net, especially if you do not have much wiggle room in your budget anyway. But it’s important to save what you can.

Ben Faulkner, from EQ Investors, says: “The Office for Budget Responsibility believes a no-deal Brexit would plunge the UK into a recession, shrinking the economy by 2 per cent and push unemployment above 5 per cent.

“Establish a rainy day fund in an easy access savings account.”

Like most financial commentators, he recommends accumulating three to six months’ worth of salary in an account in order to ride out any storms. That’s clearly not going to be possible if you don’t already have that cushion saved.

But anything extra you can set aside between now and the possible no-deal day will help you cope a little better with any surprises that lie ahead.

Know exactly what you’ve borrowed

There are so many different ways to borrow money, with store cards, overdrafts, credit cards and car finance that it can be all too easy to lose track of exactly what you owe.

But if there are difficult times ahead then it’s essential to understand exactly what you owe and to have a repayment plan in place.

That way you can avoid that debt unintentionally creeping up if there is financial uncertainty ahead. Also, if you’re steadily repaying any outstanding debt then you will be improving your credit score too.

Think about fixing

There’s no crystal ball when it comes to interest rates on credit products. However, if uncertainty causes you anxiety then it might be time to take action.

Justin Basini, co-founder of credit checking company ClearScore, says: “Brexit makes it difficult to predict what will happen in terms of interest rates. If the economy is struggling then they may stay low, but if inflation goes up then they may rise further.”

You could consider switching to lower rates or even consolidating any debt so you know exactly where you are with repayments and interest.

Investors: keep calm and go global

There is a rocky road ahead but Michelle Pearce-Burke, co-founder of robo-investment service Wealthify, says it’s important for investors not to make any sudden movements.

“For investors, the key thing to remember is not to panic. If markets drop further as a result of a no-deal Brexit and you sell, you will make those losses real. Holding on to your investments gives them time to potentially recover and even grow, over the longer term.

“A no-deal Brexit is in all likelihood bad news for the pound. A weaker pound will impact your finances as well as the economy.

“If you’re an investor, or considering becoming one, a smart choice is to add some global investments to your portfolio that are based in other currencies like the US dollar.”

Sort your travel plans

Whatever happens with Brexit, the British love affair with travelling to the European mainland won’t go away.

But if you are planning to travel within Europe after a potential no-deal exit, it’s really important to take a few extra steps to ensure you don’t get into difficulties.

For example, you may need to renew your passport sooner than expected. Just now, British citizens are able to enter “Schengen area” countries with a valid passport, even if it has as little as a day left before it expires.

However, if we do leave with no deal then the government’s advice is to renew if you have less than six months left on your passport, or you may not be allowed to travel.

A no-deal Brexit may cause delays at the airports as British travellers are no longer able to pass through the EU citizen passport controls, which are often quicker.

Without EU membership and unless something is arranged as part of a Brexit deal, travellers could no longer rely on a European Health Insurance Card (Ehic) to allow them to use local medical services on the same terms as a resident in an emergency.

That means that travel insurance is more essential than ever, as even a short visit to hospital could rack up thousands of pounds in medical bills. The price of cover may rise if British tourists can no longer rely on their Ehic but it will still be far cheaper than hospital bills.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies